FY20 FULL YEAR RESULTS

Continued Earnings Growth with operating leverage

and further Margin Expansion

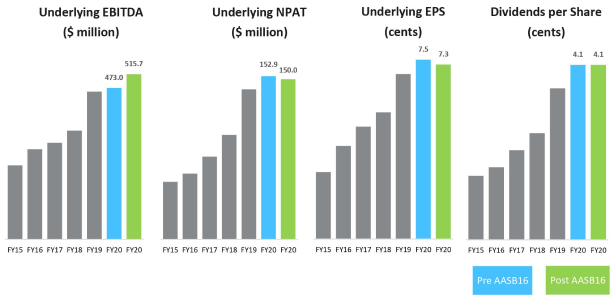

Underlying EPS up 8.7%, Total Dividend up 15.5% to 4.1c Fully Franked

Cleanaway Waste Management Limited (“Cleanaway”) ASX:CWY today announced its financial results for the year ended 30 June 2020 (“FY20”).

On an Underlying (pre AASB161) basis (unless specified otherwise) compared to the year ended 30 June 2019 (“FY19”) Cleanaway reported:

- NPAT of $152.9 million, up 8.7% (Statutory NPAT of $112.6 million, down 6.6%)

- EBIT of $251.9 million, up 4.6% with 60 bps margin expansion to record 12.0%

- EBITDA of $473.0 million, up 2.5% with 60 bps margin expansion to record 22.5%

- Free cash flow of $230.1 million, up 11.5%

- Footprint 2025 Progress:

- Integration of Toxfree and SKM businesses completed

- Committed to proceeding with a PET Plastic Pelletising facility

- Advancing Energy-from-Waste project in Sydney, with EIS submitted

- Major elements of the legacy landfill rectification complete

- Defensive characteristics of revenue streams demonstrated again during Covid-19

Note 1: The term “pre AASB16” describes financial results that exclude the impact of the new accounting standard to better enable comparison with prior periods. AASB16 has not been applied, and does not apply, to FY19 financial results or comparatives above.

|

Underlying |

Underlying |

||||||

| FY20 | vs FY19 | FY20 | vs FY19 | ||||

| Gross revenue ($m) | 2,332 | +2.1% | 2,332 | +2.1% | |||

| Net revenue ($m) | 2,100 | -0.4% | 2,100 | -0.4% | |||

| EBITDA ($m) | 473.0 | +2.5% | 515.7 | +11.7% | |||

| EBIT ($m) | 251.9 | +4.6% | 256.6 | +6.6% | |||

| Net profit after tax ($m) | 152.9 | +8.7% | 150.0 | +6.7% | |||

| Earnings per share (cents) | 7.5 | +8.7% | 7.3 | +5.8% | |||

| NPATA2 ($m) | 164.6 | +8.4% | 161.7 | +6.5% | |||

| Final dividend declared (cents per share) | 2.1 | +10.5% | 2.1 | +10.5% | |||

| Total dividends (cents per share) | 4.1 | +15.5% | 4.1 | +15.5% | |||

| Statutory Operating Cash Flow ($m) | 366.0 | +4.3% | 401.5 | +14.5% | |||

| Free cash flow ($m) | 230.1 | +11.5% | 274.4 | +32.9% | |||

| Net Debt to EBITDA (times) | 1.46x | +0.03x | 1.85x | +0.42x | |||

Statutory Net Profit After Tax was $112.6 million. This includes underlying adjustments totalling $37.4 million after tax, largely comprising acquisitions and integration costs (Toxfree, SKM) and net costs associated with the Perth Material Recycling Facility fire.

Management Commentary

Chief Executive Officer and Managing Director of Cleanaway, Vik Bansal, said “I am pleased to report results that once again reflect the strength of Cleanaway.

“FY20 presented a number of new challenges and I am immensely proud of the way in which everyone at Cleanaway responded by adapting their lives and work practices to provide safe, reliable and efficient service to our customers despite the disruption caused by the Covid-19 pandemic.

“The safety, health and wellbeing of all Cleanaway’s staff, contractors, customers, and members of the public remains paramount. Every one of our employees understands that health and safety is a shared responsibility. As we continue to work towards our target of Zero Harm, we will continue to raise awareness, enhance our training, and identify and respond to health and safety risks.

“Our financial results highlight the defensive characteristics of our revenue streams. Each of our operating segments – Solid Waste Services, Industrial & Waste Services and Liquid Waste & Health Services – performed well during the year despite the effect of Covid-19, which highlights the diversification benefit of our operating segments and strength of our business.

“Cleanaway continued to deliver on both short and medium-term commitments in FY20. We:

- completed the integration of the Toxfree business on time and are benefiting from over $35 million of annual synergies;

- completed the majority of the legacy landfill remediation and rectification program, which will free up over $25 million of cash per annum through to FY25 and over $35 million per annum thereafter;

- completed the acquisition, integration, and rehabilitation of the former SKM Recycling Group’s assets and expect to process over 200,000 tonnes of recyclable materials per annum, with opportunities to increase that volume as we fine tune operations; and

- delivered our first Sustainability Report aligned to the United Nations Sustainable Development Goals (SDGs) and the Sustainability Accounting Standards Board (SASB) Standard.

“We have reached the halfway mark in our Footprint 2025 journey and I believe we have created strong foundations for the future growth of the business. Over the past year we strengthened our position as Australia’s leading integrated waste management business through our acquisition of most of the SKM Recycling Group’s resource recovery assets, and the successful integration of both those assets and the Toxfree business. These acquisitions largely completed our Victorian and Tasmanian resource recovery footprints. We remain the market leader in every sector in which we operate, and our network of prized waste infrastructure assets across the country continues to grow.

“Our objective to drive a circular economy in Australia continues and in the coming years we will pursue several key projects that are strategically important for our business. Our proposed energy-from-waste facility in Western Sydney provides a more environmentally friendly solution to Sydney’s growing waste disposal needs.

“We also announced a plastic pelletising plant in Albury NSW in a joint venture with Pact Group Holdings Ltd and Asahi Beverages. This facility will create a genuine closed loop recycling solution for the plastics we currently recover through our collections network.”

Dividend

A final dividend of 2.1 cents per share (pcp: 1.9 cents per share) has been declared, representing an increase of 10.5% on the final dividend paid last year. This takes the total dividends for the year to 4.1 cents per share (pcp: 3.55 cents per share). The dividend will be fully franked and paid on 6 October 2020 to shareholders on the register as at 14 September 2020.

The Dividend Reinvestment Plan (DRP) will be in operation for this dividend. Shareholders residing in Australia or New Zealand may elect to participate in the DRP. The DRP election date is 15 September 2020. Under the DRP, Cleanaway shares will be issued at the average of the daily Volume Weighted Average Price (VWAP) of all shares sold on ASX over the period from 16 to 22 September 2020. No discount will be applied to shares issued under the DRP.

Underlying Segment Performance

Solid Waste Services

Solids Waste Services reported increased net revenue and earnings.

Compared to FY19, net revenue increased 0.8% to $1,372.8 million. Excluding commodities, FY20 net revenue increased 2.4% from $1,267.9 million to $1,298.3 million.

EBITDA (pre AASB16) increased 1.5% to $358.1 million ($388.3 million post AASB16) and EBIT (pre AASB16) was up 2.5% to $209.2 million ($212.7 million post AASB16).

EBITDA margins (pre AASB16) improved 20 basis points to 26.1% (28.3% post AASB16).

The result reflects the impact of Covid-19 and lower commodity prices, which was partially offset by reduced rebates to customers. The introduction of a landfill levy in Queensland on 1 July 2019 resulted in reduced landfill volumes in Queensland, which were partially offset by higher collections and resource recovery volumes.

Upgrading of the SKM assets has been completed enabling Cleanaway to produce higher quality commodities that will ultimately be reused in new products as we move further towards a circular economy. We expect these assets to deliver a full year contribution in FY21.

The clean-up of the Perth Material Recycling Facility was completed in the second half of FY20 and we are continuing to work with our customers to develop alternative solutions, while our new facility is being constructed. Completion is targeted for the third quarter of FY21. Once complete, it will deliver a better high-quality recycling service to the Perth market.

During the period Cleanaway successfully tendered for the City of Casey (Melbourne’s largest municipality), the South Australian Council Solutions, and Wyndham and Randwick municipal contracts. The City of Casey and the South Australian Council Solutions contracts commenced on 1 July 2020 with the two others to commence later in FY21.

In coming months, construction of a plastic pelletising plant in Albury NSW will commence. The plant is being developed in a joint venture with Pact Group Holdings Ltd and Asahi Beverages and is expected to be commissioned by December 2021.

The WA regional CDS scheme “Containers for Change” is expected to commence on 1 October 2020 with Cleanaway providing logistics and processing services.

Industrial & Waste Services

Industrial & Waste Services reported lower net revenue and earnings.

Compared to FY19, net revenue decreased 8.3% to $313.4 million as the business reduced its exposure to lower margin less specialised services.

EBITDA (pre AASB16) decreased 3.6% to $44.9 million ($45.9 million post AASB16), and EBIT (pre AASB16) decreased 4.9% to $21.4 million ($21.4 million post AASB16).

EBITDA margins (pre AASB16) increased 70 basis points to 14.3% (14.6% post AASB16) because of focus on higher margin work, a continued focus on increased labour and asset utilisation and realisation of synergies from significant integration related activities.

Liquid Waste & Health Services

Liquid Waste & Health Services reported increased net revenue and earnings.

Compared to FY19, net revenue increased 3.8% to $513.6 million. EBITDA (pre AASB16) increased 12.7% to $97.9 million ($106.3 million post AASB16) and EBIT (pre AASB16) increased 16.9% to $63.1 million ($64.3 million post AASB16).

EBITDA margins (pre AASB16) increased 150 basis points to 19.1% (20.7% post AASB16).

Hydrocarbons performed strongly on the back of improved volume and production efficiencies following recent plant upgrades, partially offset by lower global oil prices in the last quarter.

Health Services continues to grow with the re-signing of some of its major customers for a further 3-5 years. This business remains on track to deliver on our strategic expectations.

Packaged and bulk hazardous waste streams continue to grow both revenue and earnings.

FY21 Outlook

Trading conditions so far this year have been mixed across the country. The impact of Covid-19 continues to be more pronounced in Victoria. We saw some recovery in June over April and May.

Enterprise performance in July 2020 has been in line with the FY20 average monthly performance.

Responsive and proportionate cost management will continue to be actioned as we see market conditions changing. Trading conditions remain too variable to provide guidance currently. We will provide a further trading update at the Annual General Meeting on 14 October 2020.

Investor Briefing

The Company will be holding an investor and analyst briefing on the results at 9.30am (AEST) today

Presenters: CEO and Managing Director – Mr Vik Bansal

CFO – Mr Brendan Gill

Tele‐conference: Register at https://s1.c-conf.com/diamondpass/10008048-invite.html

Webcast: https://services.choruscall.com.au/webcast/cleanaway-200826.html

Investor Relations

Richie Farrell

Head of Investor Relations

+61 409 829 014

Email: richie.farrell@cleanaway.com.au